Transunion, Equifax & Experian Credit Scores: What Are the Differences & How Do They Affect Your Credit Rating?

When people hear the words “credit score,” most people picture one score that details their credit history and patterns. However, they’d be wrong. The fact is, there isn’t just one overall credit score. There are in fact three major credit reporting agencies in the US (know as the Big Three) and each of them have their own unique scoring method. Not only that, but they also have different criteria as to what makes a “good” credit score.

When people hear the words “credit score,” most people picture one score that details their credit history and patterns. However, they’d be wrong. The fact is, there isn’t just one overall credit score. There are in fact three major credit reporting agencies in the US (know as the Big Three) and each of them have their own unique scoring method. Not only that, but they also have different criteria as to what makes a “good” credit score.

Here’s a brief breakdown of each:

TransUnion

With a start in the credit industry in 1969, TransUnion has grown to be the 3rd largest credit bureau. Today, they have over 11 million customers. In addition to employment history, this bureau also offers color coded accounts based on status on your credit reports. For instance, a satisfactory account will be colored green, while a red colored account may indicate credit issues. A TransUnion score ranges from 300 to 850.

Equifax

This credit reporting agency has been around for over 100 years, making it the oldest of the big three. Since it has been around for so long, many consider Equifax to have the most reliable credit score methodology. Equifax reports include a comprehensive credit history that can go back 81 months and will show what accounts are open or closed. An Equifax score ranges from 280 to 850.

Experian

Headquartered in Dublin, Ireland, Experian employs approximately 17,000 people in 40 countries. Its vast global expansion has made it the biggest credit reporting agency in the world. Experian credit reports provide a balance history feature that lets you see the monthly balances you may be carrying on your accounts. In addition, it also provides status details that will let you know when closed or delinquent items may come off of your credit report. An Experian score ranges from 360 to 840.

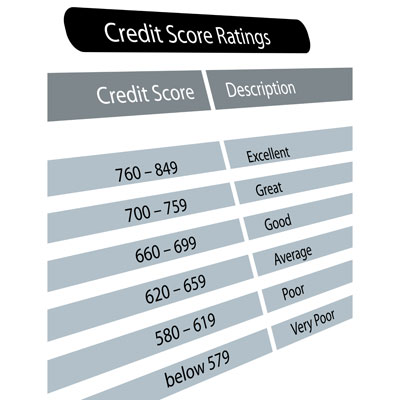

So if you have three major credit reporting agencies, all reporting different information, how do you get an accurate representation of your credit? This is where your FICO score comes in. The information in your credit report is used to calculate your FICO (the acronym stands for Fair, Isaac and Company) score. A FICO score above 700 is usually considered good. Your FICO score is also what most lenders are looking at to determine your creditworthiness.

Should I just get a FICO score?

While your FICO score may be what lenders are using when you apply for credit, the FICO score is still created based off of data the three credit reporting agencies are providing. Therefore, understanding those scores will help you understand your FICO score. Luckily, most credit reports come with reports from all three credit agencies. This a plus, since as outlined above, they all report various different information. This can be extremely helpful since a major cause of lower credit scores is actually incorrectly reported information.

When you are looking at all three reports, it’s easier to notice discrepancies. For instance, if there is a gap in employment or an account that you didn’t open. It will also help you notice fragmented information that may be affecting your overall score. If you notice one score is lower than the others, you can take a closer look as to the reasons why. Improving that score will more than likely improve your overall FICO score.

While it may all seem confusing at first, the overall gist is to make sure you know what’s on your credit report and what factors may be affecting your score negatively. That starts with requesting a copy of your credit report.

Latestpost

14

Jul

Factors That Can Help First-Time Borrowers Establish Credit

It is one thing to have bad credit in today’s wo ...

Download our

FREE GUIDE

and get weekly money-savings tips!

KnowledgeBase

Essentials